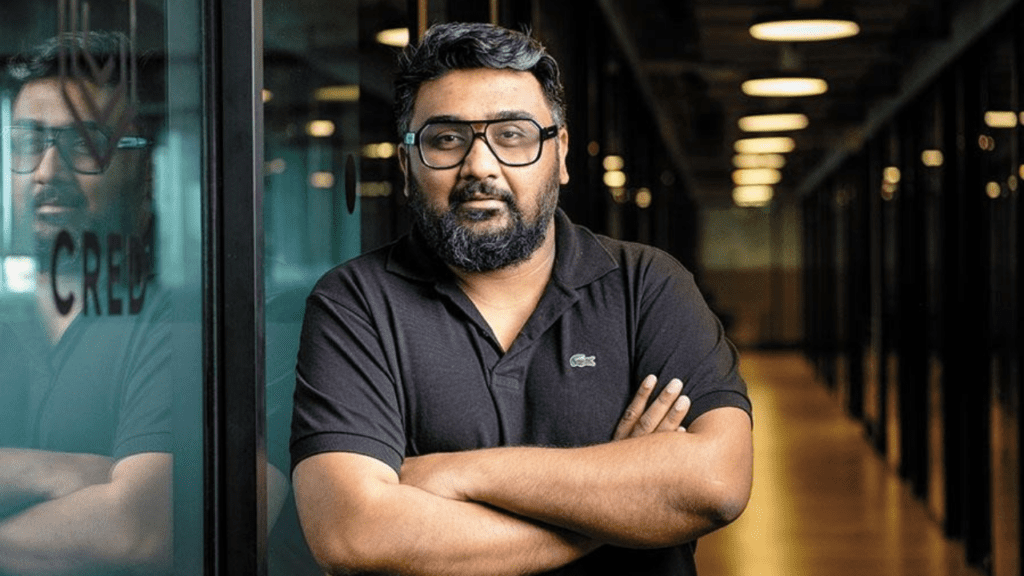

(November 9, 2021) He has run over a dozen businesses since he was 16 before founding his current success CRED, a business valued at over $4 billion. Meet Kunal Shah, the serial entrepreneur who has been making all the right moves sans any fancy MBA or engineering degree in his portfolio. What he has though is a keen business acumen and an eye for startups that hold great potential.

The philosophy graduate, incidentally dropped out of his MBA course at Mumbai’s Narsee Monjee Institute of Management Studies in 2004. But not many know that there was a time when this Global Indian would sell everything from henna cones to pirated CDs to support his family, which was then in the financial doldrums.

The entrepreneur from Mumbai

Born and raised in a Gujarati family in Mumbai, Shah’s father was into the pharmaceutical distribution business in South Mumbai. Shah realised the importance of money and financial independence early on in life when his family faced a financial crisis. That is when he went on to do several odd jobs to support his family: from selling henna cones and pirated CDs to running tuition classes and running a cyber cafe, he’s done it all.

When Shah graduated in Arts and Philosophy from Wilson College, he chose to not join the family business and instead opt to work with a BPO called TIS International Inc as a junior programmer in 2000. In 2003, he even enrolled for an MBA at Narsee Monjee, but dropped out soon after. In an interview with YourStory he said, “I realised that I was better off learning on my own than through a structured programme, because the curriculums and theories were a lot more designed for scoring marks and not really understanding things. So, to me MBA as a format did not work,” he said.

Shah met Sandeep Tandon, an investor in TIS, who struck by Shah’s personality soon developed a lasting professional relationship with him. Shah worked with the BPO for over 10 years, before deciding to branch out on his own.

The entrepreneurial streak

He then spent time working as a freelance designer and programmer before building a small SaaS company that underwent several changes and pivots to finally become Freecharge. He’d founded this with Tandon, and successfully ran it until 2016 when he chose to bow out and went on to serve as chairman and advisor to many companies such as BCCL, chairman of the Internet and Mobile Association of India, an advisor to Y Combinator and Sequoia Capital India. Incidentally, Freecharge was eventually acquired by Axis Bank.

By 2018, he decided to start up again and founded CRED, a member-only credit card payment app. The app allows members to manage all their credit cards in one place, sends them bill payment reminders and rewards them for timely payments. The startup generated massive buzz for its astronomical seed funding round and also for its unique business model.

Shah with his entrepreneurial streak, believes that one needs to risk capital to be able to grow one’s business. At the same time, he wants to see wealth of others grow as well. Shah said, “We see our fundraise as a responsibility to build a rewarding ecosystem for Cred members and an opportunity to share value with stakeholders. Hence, happy to also announce a $5 million ESOP buyback for the team members who have contributed to the Cred journey.”

Unicorn tag, high valuations are all vanity metrics till the company delivers profits.

Many companies like Amazon & Facebook were loss making for several years but became truly valuable only when they delivered profits.

Till profits, 🦄 are hope and belief of its stakeholders

— Kunal Shah (@kunalb11) April 8, 2021

In a little over two years, CRED has amassed over 6 million users and is now valued at over $4 billion. But for Shah valuations hold little meaning; he believes that unicorn tags are the hopes and beliefs of stakeholders. Earlier this year he tweeted, “Unicorn tag, high valuations are all vanity metrics till the company delivers profits. Many companies like Amazon & Facebook were loss making for several years but became truly valuable only when they delivered profits.”

Entrepreneur with a difference

Shah is also a keen observer of consumer behaviour and has been focusing his businesses on offering people a great consumer experience. CRED has been rolling out several innovative features for members such as Rentpay to pay a monthly credit card rent for a small transaction fee, CRED Cash, an instant credit line accessible in three steps.

Interestingly, Shah is also not a big believer in degrees and qualifications when hiring talent for his company. “I am a philosophy major, I can’t care about other people’s degrees that much. I do believe in people who are generally excellent and believe in excellence and care about it, it may have demonstrated in many things. For example, one of our team members, a senior leader, has not even done graduation, the best degree that person has is 10th pass, but it’s okay,” he said in an interview.

Apart from running his own business, Shah is also an active angel investor and advocate of India’s startup ecosystem. According to a recent Hurun India report, Kunal Shah tops the list of entrepreneurs with the most number of investments in startups that may turn unicorn in the next few years. He is invested in nine such companies. Shah is followed by Binny Bansal and Ratan Tata.

He is currently invested in over 50 companies including Ola and Gojek. His reasoning for investing in startups is simple. In an interview with The Ken he said, “The number one thing that I look at is what I can learn from the founders. My thesis for an investment, whether in angel rounds or up to Series B, is to be associated with the smartest minds. I let the founders determine the size of the cheque. During angel rounds, startups look for both money and potential learning or the investor’s ability to guide them from their own experience. Founders who believe I can offer that, approach me. I invest in companies and founders who are introduced to me and whom I can learn from.”

For a Mumbai lad who started off with working several odd jobs to stay afloat, Shah is now actively investing in startups in a bid to pay it forward and fund job creators for he believes that is the need of the hour: job creators.