(April 1, 2024) A smart investor, thriving entrepreneur, and a dedicated philanthropist, Indian American Mohnish Pabrai has reached great heights from the obscurity of Bombay to the financial peak and fame in the US. The author of ‘The Dhandho Investor,’ and ‘Mosaic’ has followed in the footsteps of two of the most esteemed investors in history, Warren Buffett and Charlie Munger, who later became his mentor and dear friend.

Pabrai’s ambition has been bold and clear – to transform $1 million in savings into a $1 billion fortune by replicating Buffett’s investment approach.

In 2022 when Pabrai received a letter from Warren Buffett, he couldn’t have been happier. Acknowledging the impressive annual report of the Indian American philanthropist’s non-profit Dakshana Foundation, Buffet wrote:

Dear Mohnish,

I remain incredibly impressed by what you have done, are doing and will do at Dakshana. It is simply terrific – far more impressive than what business titans, investment gurus and famous politicians ever accomplish. I’m glad my annual report doesn’t get compared to the Dakshana annual report. It’s an honour even to be quoted in it.

With admiration – Warren E. Buffet

So far, Pabrai has secured investments totalling ₹130 crore for his foundation transforming nearly 40,000 lives forever.

Giving back

When Pabrai co-founded the Dakshana Foundation in 2007, he became a key figure in providing needy students in India good education and helpful guidance, helping them start successful careers. Dakshana’s primary focus is on combating poverty through education. The non-profit achieves this by identifying exceptionally talented but financially disadvantaged teenagers and offering them rigorous coaching along with hostel facilities for one or two years to prepare for the IITs and medical entrance exams.

The foundation has witnessed thousands of scholars being getting admitted to India’s prestigious IITs, and medical schools. Dakshana Scholars are exceptional students selected from Jawahar Navodaya Vidyalayas and government schools across India based on their academic performance and results from Dakshana’s unique testing process. They receive specialised coaching after completing Class 10 or Class 12.

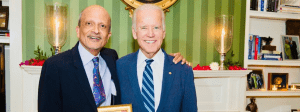

Mohnish Pabrai with Dakshana Scholars

Pabrai comes across as a very fun-loving and relaxed individual when interacting with the scholars of his foundation, often leaving them in splits of laughter. During one such interaction, he recounted a childhood incident, saying, “I used to have very low self-esteem and thought I was significantly below average. I remember when I was in the third standard, in a class with a large size of about 60 students. We received report cards with our ranks on them. I distinctly recall my rank was 57 out of 60. I used to sit at the back, not understanding what was being taught, and I wondered why I didn’t get a perfect score of 60 out of 60!”

The flight of life

Mohnish Pabrai was born in Mumbai in 1964. His father’s job took him to different cities in India and Dubai which gave him the opportunity to study in various schools including Jamnabai Narsee School, Maneckji Cooper Education Trust School, The Air Force School in New Delhi, and The Indian High School in Dubai. These different schools influenced his outlook on life.

After completing his school education, he went on to pursue a Bachelor of Science degree in computer engineering from Clemson University, showing his early talent for technology, even though he had studied commerce in his 11th and 12th grade. He continued to learn by attending the YPO Harvard President’s Seminar for nine years, eventually being recognised as an alumnus of Harvard Business School.

From 1986 to 1991, Pabrai worked at Tellabs, a technology startup, and then went on to found TransTech Inc., an IT consulting and systems integration company in 1991, investing $30,000 from his personal account and credit card debt. Despite facing challenges initially, his determination led TransTech to success. After nine years, Pabrai sold the company for $20 million to Kurt Salmon Associates.

Successful investing is not about picking winners; it’s about avoiding losers. Focus on preserving your capital first, and then look for opportunities to grow it over time.

Mohnish Pabrai mentioned in his book, ‘The Dhandho Investor’

Inspired by Warren Buffet and Charlie Munger

Pabrai’s investment strategy focuses on identifying severely undervalued companies with the potential for substantial returns.

He had established the Pabrai Investment Funds, a hedge fund family inspired by Buffett Partnerships in 1999. In a matter of four years, his long-only equities portfolio returned 517 percent of the invested amount. This meteoric growth catapulted him to prominence in the financial world. People started taking notice of his strategic thinking and investing acumen which was inspired by Warren Buffet’s investment philosophies.

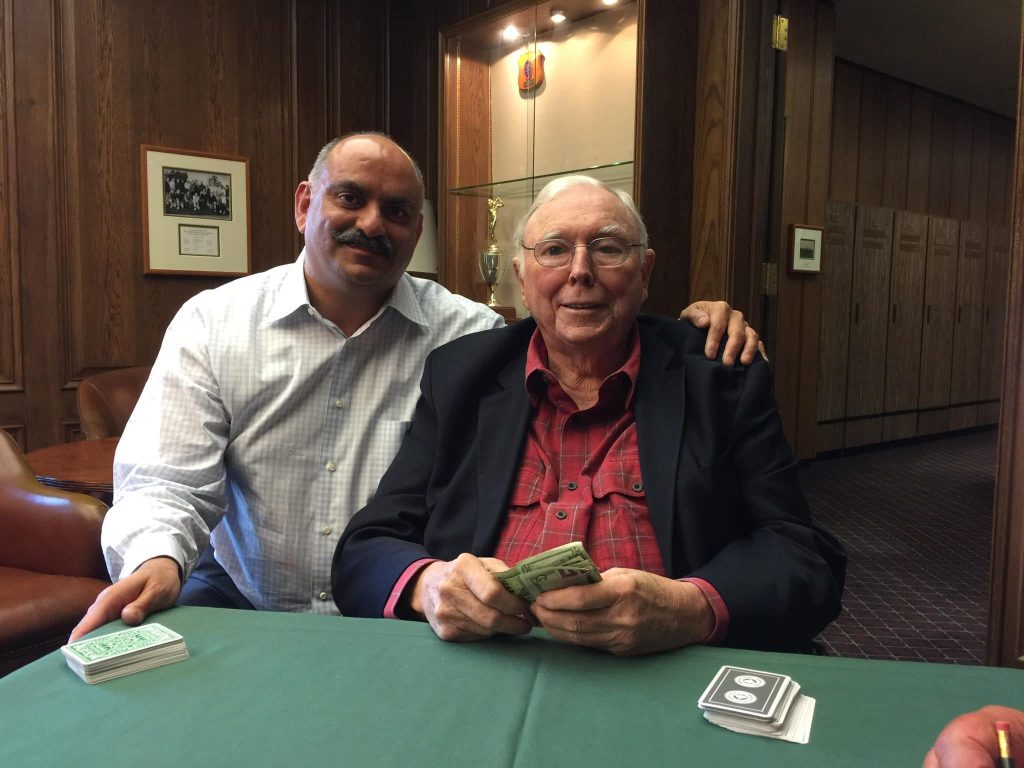

Mohnish Pabrai with Charlie Munger

I have two gurus Warren Buffett and Charlie Munger. One of the things I learned from them which kind of took me a long time to actually figure this out, is that if you want to do well in life then what you should avoid doing is looking back.

Mohnish Pabrai

Pabrai had developed lasting friendship with late American businessman, investor and philanthropist Charlie Munger while being his mentee, and often followed his philosophies in life. Four months back when Munger passed away, Pabrai tweeted, “I lost a dear friend, mentor and teacher. As a kid from Mumbai, I never expected to have a friendship with Charlie Munger…”

In December 2023, Pabrai’s net worth was estimated to be $150 million. The bulk of his wealth accumulation are a result of his savvy investment decisions, with stakes in companies like Micron Technology, General Motors Company, and Bank of America Corporation, among others.

Also Read | Frank Islam: The Indian American visionary is bridging worlds through philanthropy, leadership and influence

Heads I Win, Tails I Don’t Lose

Apart from being the founder and managing partner of Pabrai Investment Funds that manages over $1 billion in assets, the investor serves as portfolio manager of Pabrai Wagons Funds, founder and CEO of Dhandho Funds, and chairman and CEO of Dhandho Holdings.

Mohnish Pabrai has crafted his own winning mantra – ‘Heads I Win, Tails I Don’t Lose.’ With this mindset he carefully selects companies which are undervalued in the market but have strong fundamentals and intrinsic values that can be reaped for good results. Employing this approach, he has mastered the art of value investing, achieving outstanding returns on his investments while minimising risks.

Not shy of sharing his knowledge

Beyond investment management Pabrai loves to share his insights with aspiring investors and professionals in the world of finance. He has shared his insights in two of his well acclaimed books – ‘The Dhandho Investor: The Low-Risk Formula for Value Investing’ published in 2011 and ‘Mosaic: Perspectives on Investing’ published in 2017.

These books provide practical advice and valuable insights drawn from his extensive experience and research in investing. His insights get quoted quite often. In fact, in Guy Spier’s book, ‘The Education of a Value Investor,’ there is a chapter titled “Doing Business the Buffett-Pabrai Way,’ which thoroughly explores Pabrai’s life and investment philosophy.

In addition to books, the investor frequently contributes articles to prestigious publications, offering commentary on current market trends, investment strategies, and the broader principles of value investing. His engaging writing style makes complex financial concepts understandable to a wider audience.

Mohnish Pabrai also actively interacts with the community through lectures and presentations. His thought-provoking speeches are full of humour, keen observations, and practical advice, empowering the investor community.

You don’t make money when you buy stocks. And you don’t make money when you sell stocks. You make money by waiting. The biggest asset of a value investor is not his IQ but his patience.

Mohnish Pabrai

Following his mentor Charlie Munger’s philosophy of ‘focusing on continuous improvement instead of dwelling on past’, the Indian American investor is always on a quest to reach fresh heights in the journey of life.

A little known fact:

Mohnish Pabrai is the grandson of world-renowned magician, late Gogia Pasha who earned international acclaim for his performances.

- Follow Mohnish Pabrai on LinkedIn, X, YouTube, Facebook and his blog Chai with Pabrai