(October 6, 2023) About five decades ago, with a mere 64 Rupees in his pocket, which equated to a humble $8 US, Prem Watsa embarked on a journey to Canada. Today, the global Indian presides over an insurance empire that generates an annual revenue exceeding $10 billion, earning the moniker of the ‘Canadian Warren Buffett’.

When Watsa set sail for Canada he was in his twenties. Armed with an engineering degree from IIT Madras, he was seeking an MBA at the University of Western Ontario. To fund his education, the engineer turned into an air conditioner and furnace salesman in the foreign land. Now, at the age of 73, this Indo-Canadian stands as the wealthiest Indian in Canada owing to his astute business acumen and remarkable success. He is the visionary behind Fairfax Financial Holdings, serving as the organisation’s founder, chairman, and CEO. In January 2020, Watsa received the prestigious Padma Shri award from the Government of India. He was appointed a Member of the Order in Canada in 2015.

The campus of his alma mater, IIT Madras, a prominent educational institution in India, boasts of an expansive stadium called Watsa Stadium. The billionaire had generously contributed towards renovating this landmark facility and named it in memory of his father Manohar C Watsa. He is one of the only 150 alumni to be designated as a ‘Distinguished Alumnus’ by the prestigious Institute.

Prem Watsa inaugurated the Manohar C Watsa Stadium at IIT-M in 2017 in presence of former director B. Ramamurthy

Connected to homeland

Despite spending more than 50 years of his life in Canada, where he ascended the entrepreneurial ranks to become one of the nation’s most accomplished businessmen, Watsa has steadfastly maintained his connection to his origins. He has never lost an opportunity to be of use to his homeland.

An exemplary instance of this commitment was seen during the second wave of the COVID-19 pandemic, when the alumni of IIT Madras, both within India and abroad, collectively donated over $2 million to combat the devastating second wave in India, Watsa played one of the pivotal roles in this initiative by making a substantial contribution to this fund.

Expressing his deep appreciation for his country, Watsa said in a recent interview with Money Control, “I am excited about the opportunities in India. For everybody it is the place to come and put (invest) money in. You’ve got a 100 unicorns and there would be a ton more in India. I am so optimistic.”

Becoming a billionaire businessman

Following his MBA, Watsa joined Confederation Life, an insurance company in Canada. Starting as a junior research analyst, he went on to become a portfolio manager, spending 10 years in the organisation. It was there that he learned the gospel of value investing – of finding and investing in underappreciated public companies, an approach pioneered by legendary investors like Warren Buffet, Ben Graham and Charlie Munger.

In 1984, he ventured into the entrepreneurial world co-founding an investment firm with his former boss, Tony Hamblin, and named it Hamblin Watsa Investment Counsel.

The following year, witnessed a pivotal moment in Watsa’s career as he took over Markel Financial, a struggling Canadian trucking insurance company which was on the brink of bankruptcy. He changed its name to Fairfax Financial Holdings and nurtured the company’s growth, becoming a billionaire in the process.

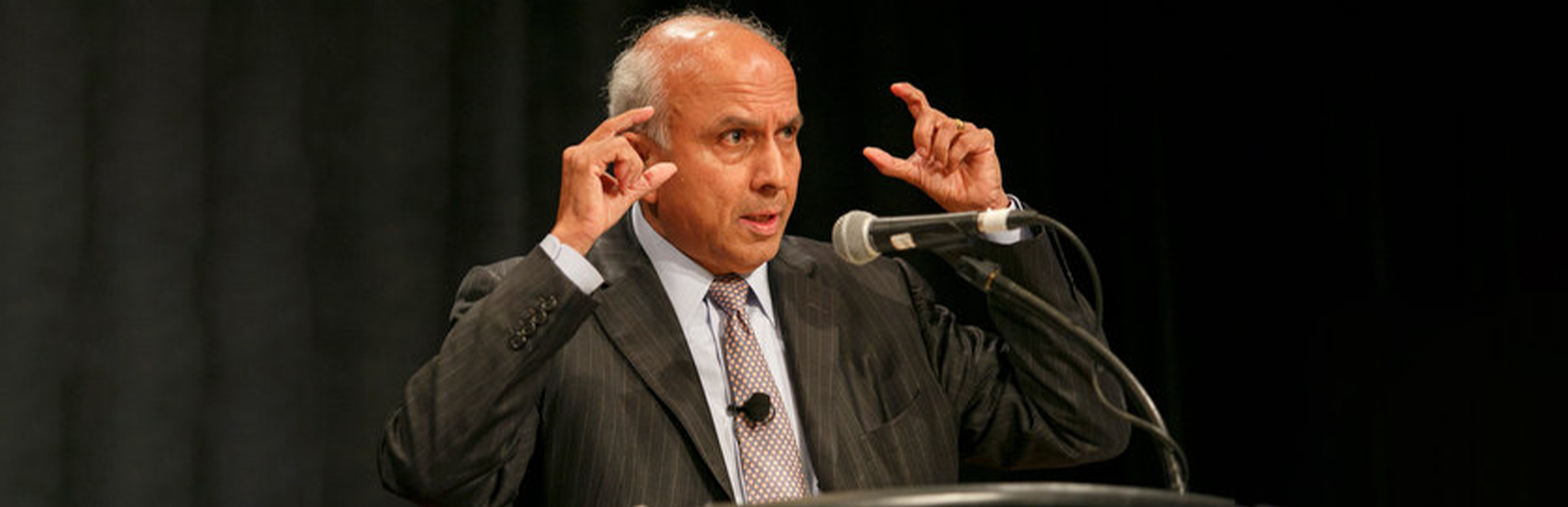

Prem Watsa during a speech at the Chamber of Commerce of Metropolitan Montreal in 2018

The name of the then startup, Fairfax, stood for ‘fair and friendly acquisitions’. The trucking insurance business was expanded to other verticals like property and casualty. Along the way, Fairfax acquired smaller insurance businesses, and worked to revive them. With Watsa’s business acumen, Fairfax Financial Holdings enjoyed an impressive growth of 25 percent every year for 25 consecutive years from 1985-2010, becoming one of the largest financial institutions in Canada.

“Canada is a fantastic country. Anything that I have done would not have happened if I didn’t come to Canada,” Watsa said in an interview with Bloomberg.

Surging ahead with low public profile

Despite his remarkable accomplishments, Watsa preferred to keep a low public profile, with investor conference calls becoming a regular practice only in 2001.

In 2013, Fairfax Financial Holdings completed a significant acquisition by securing BlackBerry in a substantial $4.7 billion deal. This strategic move has positioned Fairfax Financial Holdings as the preeminent insurer within the for-profit bail industry in the United States.

His investment portfolio in India includes holdings in entities like the Bengaluru International Airport and Catholic Syrian Bank, to name a few. However, it was his venture into Indian insurtech unicorn Digit Insurance that truly captured attention, as it yielded a staggering $1.4 billion profit following a recent share sale by the start-up.

“The current boom in India’s start-up industry will open up more avenues and create a level playing field for all those with a drive for entrepreneurship,” he shared with Money Control.

The course of life

Born in Hyderabad, Watsa’s educational journey began at Hyderabad Public School. He then secured a seat at the Indian Institute of Technology Madras, from where he passed out with a degree in chemical engineering in 1971. Following this, he moved to Ontario, Canada and enrolled in the Richard Ivey School of Business at the University of Western Ontario, where he earned his MBA degree.

Apart from finding great success as a businessman, Watsa has been the chancellor of University of Waterloo and Huron University College, and member of the advisory board of his alma mater, the Richard Ivey School of Business.

He has also been involved in various philanthropic activities, the most notable being his involvement with The Hospital for Sick Children in Canada as the member of the board of trustees, and one of the board of directors of the Royal Ontario Museum Foundation.

Extremely passionate about his business, Watsa remarked in an interview, “I am hoping that in a 100 years my company would still be here in Toronto. That’s what we are trying to build – a company that lasts.”

During a speech at the Chamber of Commerce of Metropolitan Montreal, Prem Watsa outlined the following seven principles of business success:

- Think long term

- The company is not for sale

- Shed bureaucracy at your workplace

- Success does not come at the expense of family

- Always maintain a team-oriented approach

- Give back to society

- Never compromise on integrity