(June 29, 2024) Around 2.2 million people in Bengaluru live in slums, according to data from a 2017 report. The survey, conducted by the Karnataka Slum Development Board 2011, found that nearly a quarter of the state’s slum areas are located in Bengaluru. That’s about 16 percent of the city’s total population and despite the recent efforts to rehabilitate, government schemes are still a drop in the ocean. Slum-dwellers in the heart of the city have been around for generations – they are the city’s auto drivers, pushcart vendors and ragpickers but for all their years in Bengaluru, not much has improved.

This is the demographic to which Mallika Ghosh has dedicated her life. Her philanthropic bent is no surprise – her father, Samit Ghosh, founded Ujjivan Financial Services, India’s first microlending institution for the urban poor, inspired by Muhammad Yunus’ Grameen. Her mother, Elaine Ghosh, founded Parinaam Foundation in 2006 when she discovered a sub-section of people who are too poor even for microcredit. Inhabitants of these shanty towns have little to no documentation, lack access to government welfare schemes and to the financial system. After Elaine passed away in 2013, her daughter, Mallika, who now lives in Bengaluru, took over as the executive director of the Parinaam Foundation.

Mallika Ghosh, Parinaam Foundation

A change of heart

It was her father who suggested, in 2009, that she work with her mother Elaine at the Parinaam Foundation. At the time, Mallika had just turned her back on a career in filmmaking, on which she had invested many years of her life already. After graduating from Emerson College in Boston, Mallika returned to India in 2003, working with an ad agency in Bengaluru and then joining the film department of McCann Erikson. “I worked there for two years and by the time I left, I was heading the department,” she says.

At home, her banker parents, who had hoped to spend their retirement years in Bengaluru surrounded by friends, had plunged into social work and philanthropy instead. “My father had also been persuaded by Aditya Puri, who was a good friend, to help him set up HDFC Bank,” Mallika says. In 2004, however, he began Ujjivan Financial Services.

That was when she “went through another crisis. Every few years, I go through a crisis that changes my way of seeing things,” Mallika remarks. She had begun to understand that success in a creative field requires good fortune and Mallika was “not ready to leave her career to luck. I was very jaded by the ad world,” she says. Spending obscene amounts of money on “30-second films… and for what? What are we trying to achieve? Sure, we feel accomplished at the end of it but then, I would go home and see dad and mom do work that’s actually making a difference to people’s lives. And I thought, no, this is not what I want anymore.”

Financial services for the urban ultra poor

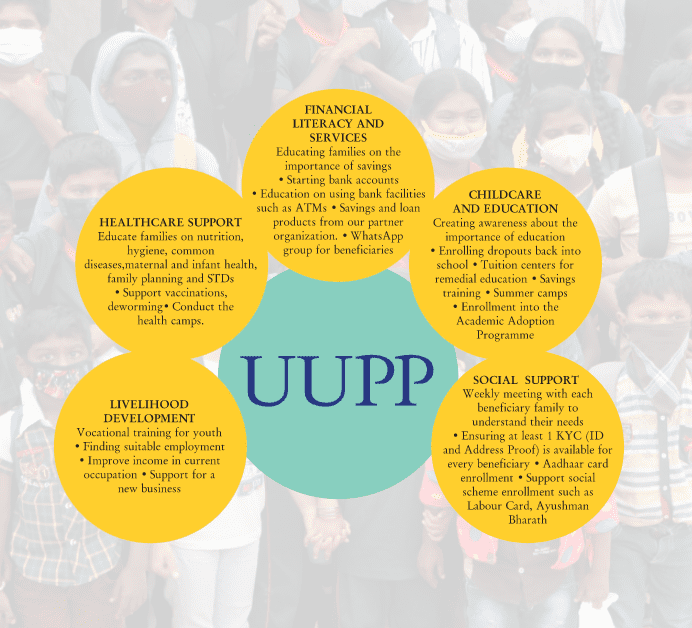

Mallika started out managing a summer camp for the three communities involved with the foundation at that time. She also became part of the financial literacy project or Diksha, part of the Urban Ultra Poor Programme (UUPP), working in collaboration with Ujjivan.

“Everyone needs access to financial products. How do you get them a loan and ensure they pay it back?” This led to the creation of the programme and once a week, women from these communities are taught how to manage their finances. The foundation also opens savings banks accounts in their names so they get access to essential financial services. The programme has impacted almost a million people to date, “all educated by a programme I wrote on a train to Odisha,” Mallika says. ‘Diksha’ has been recognised as a pioneering programme by the Reserve Bank of India.

Named the Asia-Pacific winner of the 2013 Financial Times and Citi Ingenuity Awards: Urban Ideas in Action Programme, UUPP has impacted over 8000 families in 135 communities in Bengaluru (according to their website). These are the poorest of the poor, living in urban slums without documentation, access to government schemes, healthcare, education or financial services.

The summer camps have grown too – they now work with over fifty communities and some 1600 kids.

Image credit: Parinaam Foundation

Academic Adoption Programme

In 2011, the first batch of slum children travelled in Mallika’s old Maruti Van to begin their education at Indus Community School in Bengaluru. The school had agreed to admit the kids, as long as the transport was handled by the Foundation. “It came at a huge cost but mum said, ‘I don’t care’. And we did it.” This would mark the start of the Academic Adoption Programme, which, ten years later, has 1000 kids spread across 150 schools.

Having toyed briefly with the idea of running her own school but realised she knew nothing about running one. Besides, there were already plenty of good private schools available. The challenge lay in persuading parents who placed no value on education to send their children to study. The Parinaam Foundation now collaborates with schools and communities, operating buses that bring children from the slum areas to school each day.

The first batch of children are taking their competitive entrance exams or embarking on vocational courses. “The earlier batches are now in their teens, so I also hear a lot of love sagas and other such problems,” Mallika laughs. “I suppose it will prepare me for when my own kids become teenagers!”

View this post on Instagram

At the helm of Parinaam Foundation

“When ma passed away, there were so many challenges, other than having just lost my mother,” Mallika says. “I had always been in the operations side, working on scaling up and so on. I had never handled things like fundraising and finance, which I had to take on then.” Running an NGO, she realised, meant building a team. “Your company is as good as your team. I have a very good one.”

The Parinaam Foundation employs 35 people, while the financial literacy programme has a team of 100 (they are on the Ujjivan rolls). Under this, the team caters to a variety of needs, starting bank accounts for those who need them, meeting healthcare requirements and so on. During Covid, this also involved getting them vaccinated and providing cash relief when it was needed. “Most of our employees for the programme are field workers,” she says.

Community Development Programme

In 2017, Mallika took over Ujjivan’s CSR work, taking on infrastructure-related community development projects. They collaborated with Bhoomiputra Architecture; a Bengaluru-based architecture firm founded by award-winning architect Alok Shetty to help meet infrastructure needs. “We have done over 250 projects through Ujjivan,” adds Mallika. This includes projects like fixing up a run-down school or sprucing up the maternity ward in a hospital.

View this post on Instagram

During the pandemic, hospitals needed infrastructural help as well and they worked with around 60 healthcare institutions. “We would help with equipment for other ailments, waiting rooms, maternity wards and so on.” In Guwahati, they created a theatre area for a community that enjoyed cultural activity – it included a stage and a green room. In Assam, it was a community centre for women. Their donors include HSBC, Bajaj and Dubai Duty Free, to name a few. “We are looking at revamping entire communities through good sewage systems, community centres and ‘pukka’ houses,” Mallika explains. “This means collaborating with the government because they own the land.”

The journey so far

Mallika lives in Bengaluru with her husband and two kids and looks back on her professional journey with satisfaction. “We’re helping the people who build our cities, clean the roads and our homes. They have been in the city for so long and have so little. I am glad to have the opportunity to change their lives in some way.”