(January 31, 2025) When Mihir Patki and his three classmates from the University of Oxford drove into Kenya’s Tana Delta to do a feasibility study for setting up a mango processing factory as part of their university project, it seemed like a mission impossible. The conflict between the two tribes inhabiting the region—Pokomo and Somali—would often escalate, keeping the MBA students on the edge throughout their one-and-a-half-month stay, sans electricity.

But that was more than a decade ago. Today, a factory stands at that location, ensuring a longer shelf life of the pulp and opening employment opportunities. “That experience taught me essential life skills, and empathy and erased the fear of starting something from scratch,” smiles Mihir Patki, an investment professional with a deep passion for personal finance and nutrition, in a chat with Global Indian.

Mihir Patki

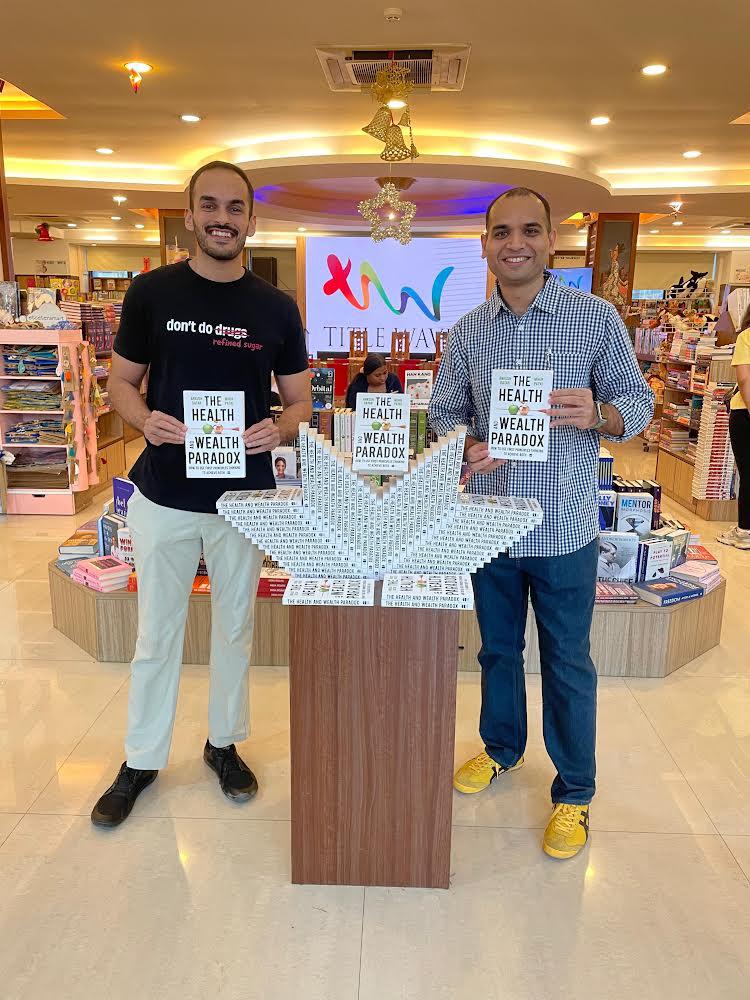

Mihir, who started his career at Deloitte before transitioning to various capital markets roles with Bank of America Merrill Lynch and JM Financial, co-authored a book The Health and Wealth Paradox which hit the shelves recently. The book dives deep into the timeless link between smart investing and healthy eating.

Exploring the Link Between Smart Investing and Healthy Living

He calls investing and healthy eating boring activities. “Sustained habits and routine over a long time is a common trait of smart investors and healthy eaters. Both are about what you don’t do rather than what you do,” says Mihir, pointing out that avoiding bad investments helps you build wealth, just as skipping unhealthy foods is more important for staying healthy than focusing solely on what you eat.

Controlling impulses and the urge to act is common to both. “Having a framework is easy, abiding by it is hard. Both these topics require one to have technical knowledge about finance or nutrition,” says Mihir, highlighting the need to have a behavioural edge rather than mere knowledge to be able to do justice.

The book gives the reader a set of principles wherein they can develop their own plan rather than trying to act anecdotally or on misinformation. “It offers a simple plan to achieve both health and wealth. Everything is quantified and backed by research. No gyaan, no macro commentary,” says Mihir, who has co-authored the book with Ankush Datar.

Received from a reader 😁💃

Bestsellers list across airports in India.

This one is from Bangalore Airport! pic.twitter.com/TJzAnzCle5

— Ankush Datar (@ankushd14) January 28, 2025

The book also highlights an important idea – that everyone’s path to health and wealth is unique. “Paths to health and wealth can be drastically different but if you drill down to their first principles, they start appearing similar,” says Mihir, whose personal transformative experience over a decade and deep-rooted passion for both investing and nutrition, led him to write the book.

Mihir believes that fitness and investing are two core life skills that aren’t taught anywhere. “Unfortunately, most people, including me, realise the importance of these things after experiencing setbacks. Else, everything is taken for granted,” feels Mihir, who had a health scare in his early 30s. Back then, he was struggling with hypertension, high cholesterol, and fatty liver. But he managed to reverse them through a sustained quantified nutrition plan and exercise. “It felt magical, like a powerful secret I had unlocked.”

From Mumbai to Oxford

Born in 1985 in Mumbai, Mihir was raised in Nasik by parents who practiced Chartered Accountancy. A bright student, he studied at Fravashi Academy, Nasik, and also spent years learning tabla.

With his parents’ office and their residence on the same premises, a young Mihir had early access to computers which sparked his interest in programming. “I learnt Visual Basic and developed some software for local businesses that made me some pocket money,” recalls Mihir.

However, his poor performance in SSC board exams led him to drop the dream of pursuing engineering. Instead, he enrolled in commerce and decided to pursue CA, much like his parents. Around the same time, the Patki family relocated to Mumbai where Mihir completed his B.Com from RA Podar College of Commerce & Economics. Subsequently, he enrolled at the Institute of Chartered Accountants of India (ICAI).

During his three-year articleship with Deloitte (2005-2008), Mihir realised that CA wasn’t his calling. “Finance and investing interested me more,” he shares. In September 2008, at the height of the Lehman Crisis, he joined Bank of America Merrill Lynch (erstwhile DSP Merrill Lynch) in Mumbai, working with the global markets finance team on exotic derivatives and valuations. By 2010, he transitioned to JM Financial’s proprietary trading desk as derivative volumes in India were picking up. “Being a trader sounded fancy back then,” says Mihir.

He co-managed a ₹600 crore arbitrage book. “At first, it felt like an adrenaline rush, but trading soon started to feel like playing a video game. I wasn’t building any fundamental skills,” says Mihir. Seeking a fresh perspective, he decided to pursue an MBA abroad and landed at Oxford University.

Best years at Oxford

Mihir calls his time at Oxford the best year of his life, where he found his tribe. “We were a close-knit class of just 193 people, so everyone knew each other on a first-name basis.” He credits Oxford for helping him build a network, both personal and professional.

At Oxford, Mihir was part of a diverse class that included engineers, doctors, lawyers, traders, and entrepreneurs. “This network helped me gather information, do research, and even plan vacations anywhere in the world,” he says. While at Oxford, Mihir got married, and his wife, who worked with ICICI Bank, supported their time there.

Many of Mihir’s closest friends today are his Oxford batchmates, now CEOs, startup founders, consulting partners, and social entrepreneurs.

Coming Home: Reviving Careers and Projects in India

After completing his MBA, Mihir returned to India in 2013 to join his family firm, CVK Advisors, which had pivoted from CA practice to debt advisory. “After a long while, I had the fulfilling feeling of ‘Yes, this is what I want to do with my career’,” says Mihir, who specialised in stressed credit and turnaround situations.

In 2015-16, the Indian banking system was grappling with an exponential increase in bad debt, and in it, Mihir saw an opportunity. “The most interesting transactions I closed was a stalled real estate project. We turned its finances around, and today it’s one of the most sought-after spaces in Mumbai,” he shares.

Multipie: A Social Network for Investors

In 2016, Mihir Patki planned to start an Asset Reconstruction Company but had to drop the idea when the capital requirement was raised to ₹100 crore – a sum impossible for someone like him to arrange. Around the time of the pandemic, he partnered with Sandeep and Raj, former colleagues from DSP, to create a new venture. They imagined a social network for investing that would help people connect, share insights, and learn from each other. That is how Multipie was born in 2020.

Multipie became a platform high-quality investors to share real portfolio insights. Users could view percentage allocations of stocks and mutual funds (with absolute values masked) and use that data to refine their own portfolios. “Multipie allowed users to look at others’ real portfolios, which led to valuable insight sharing,” Mihir explains. The platform ensured privacy while pulling real-time data directly from brokers, eliminating manual entry.

Over time, Multipie grew into a community of over 1 lakh members. In August 2022, it was acquired by ICICI Securities. “It was a dream ride,” Mihir says, reflecting on the journey of building a platform that brought long-term investors together and simplified investing as a life skill.

What’s Next: A Screenplay and Future Plans

With his book already on the shelves, he is currently working on writing a screenplay. “A financial thriller, along with a filmmaker friend,” informs Mihir.

On the work front, he intends to continue as a structured credit investor for some years. “I am enjoying my current role at Tata Capital.” However, he plans to start a fund/PMS investing capital of clients alongside his own.

Giving Back: Philanthropy at the Core

His commitment to giving back extends beyond his professional life. Mihir supports two organisations – Welfare of Stray Dogs and Roti Bank. In 2010, he was an active on-ground volunteer with Welfare of Stray Dogs but due to his busy schedule, he no longer volunteers but is a regular donor to both the organisations.

“In fact, the royalty proceeds from the book are being donated to Roti Bank,” he informs, adding that the organisation run by his close friend, D Sivanandhan, is doing excellent on-ground work of providing nutritious meals to those in need.

Mihir Patki

Brand India: Opportunities in a Youthful Nation

Mihir’s career has given him a unique lens to view India’s potential on the global stage. From navigating global markets to working on grassroots projects, he sees India as a country brimming with opportunities despite its challenges. India stands out as a bright spot in a challenging global landscape, says Mihir. “About half of India’s population is under 30, with a median age of 28 compared to 38 in China and the US, and 44 in Western Europe. Imagine the productivity this youthful population can bring,” he explains.

By 2030, India is set to add 97 million people to its workforce, overtaking China as the largest working-age population in the world. However, Mihir points out that this demographic edge comes with its own challenges. “Ensuring access to quality education, healthcare, and meaningful employment will be critical for such a large and diverse population,” he says.

With over 40% of India’s population expected to live in urban areas by 2030, the demand for infrastructure, real estate, and consumer goods will surge. “This is hard data that speaks volumes about the opportunities young Indians can seize.”

Mihir’s journey showcases his ability to adapt, learn, and make an impact. From building platforms that simplify investing to co-authoring The Health and Wealth Paradox and giving back through social causes, he has combined his passions with a purpose to help others. As he looks ahead, Mihir is focused on creating value while continuing to inspire those around him.

Read a similar story of Kanwal Rekhi, an Indian-American angel investor.