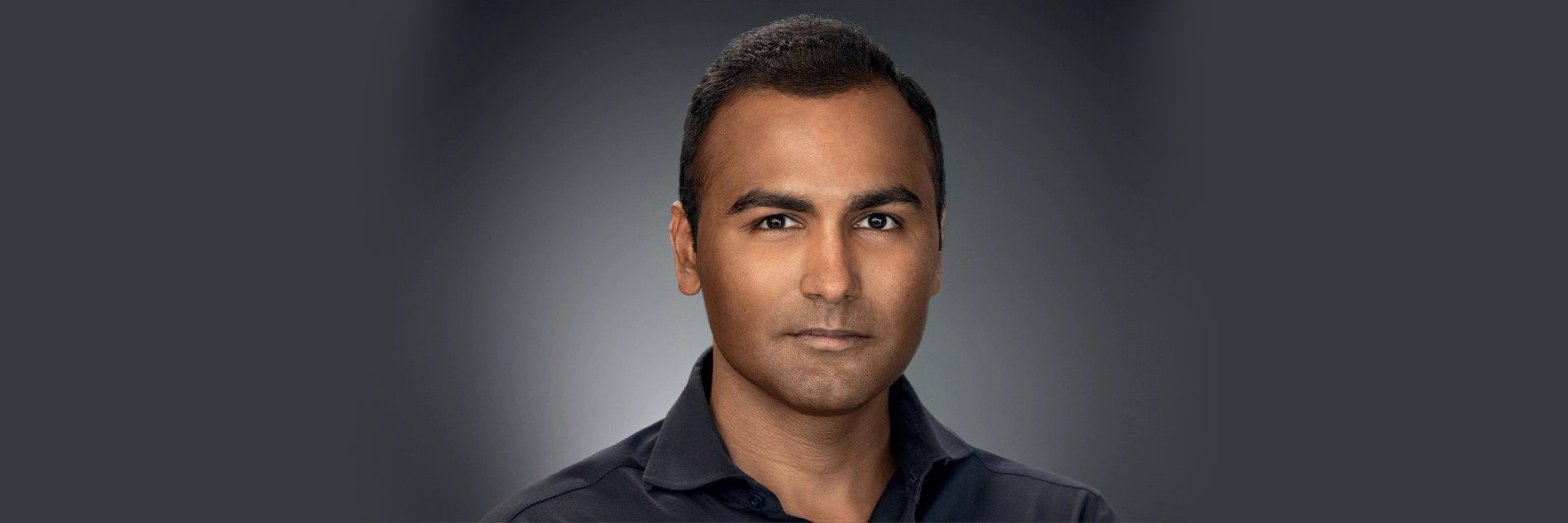

(October 8, 2021) 2020 was a tough year for many: individuals, startups, professionals, and even established firms. The pandemic had brought the global economy to a near halt. As the virus spread rapidly across the globe, losses began mounting with no end in sight to the worldwide lockdowns. Even Japanese conglomerate SoftBank Group had sunken into the doldrums as its shares plunged. It was around that time that the Group’s CEO Masayoshi Son appointed Indian-born business executive Akshay Naheta as senior vice president. Naheta was the youngest executive at the company, had direct access to Son and was in a key position to implement SoftBank’s multibillion plan to win back shareholder confidence. His investing chops had long been drawing praise from industry leaders.

During his time at SoftBank Vision Fund, Naheta had bet on Nvidia which resulted in $3 billion in profits for the company. The 40-year-old has been involved in several high-profile investments and was instrumental in the ongoing sale of British software firm ARM Limited to Nvidia, which upon closure will be the largest semiconductor M&A in history. His work, has made Naheta a force to reckon with in the world of investing. In 2020, he was featured in Fortune’s 40 Under 40 most influential people in finance list and was named Young Global Leader by World Economic Forum. Earlier this year, GQ named him in its 25 Most Influential Young Indians list.

Governments have created the largest transfer of future generational wealth from the have-nots to the haves, under the guise of covid. They turn to capitalism when the economy is doing well and socialism/cronyism especially when there are economic crises! https://t.co/4uRuvOW42c

— Akshay Naheta (@Akshay_Naheta) January 16, 2021

The lad from Mumbai who took on the world

Born in 1981 in Mumbai in a family of jewelers, Akshay Naheta found himself drawn towards mathematics and developed a passion for engineering, especially automobiles from a young age. Which is why he moved to the US in 1999 to do his Bachelors in Electrical Engineering from University of Illinois at Urbana-Champaign, where he graduated at the top of his class. While at University, he received several awards for academics, research, and leadership; last year the college also conferred upon him a Young Alumni Achievement Award. He then went on to get a Master of Science in Electrical Engineering and Computer Science from Massachusetts Institute of Technology (MIT) in 2004. Though he did enroll for a PhD at MIT, he later decided to drop out to start his career in finance. In an interview with Fortune, Naheta said, “All throughout, I yearned for a job as a venture capitalist in Silicon Valley post graduation. As fate would have it, the lure of free pizza pulled me into a Deutsche Bank job seminar led by an MIT alumnus. I struck a personal rapport with him and at the end of the conversation he convinced me to drop out of my Ph.D. to pursue a career on Wall Street.”

Akshay Naheta thus began his career as an associate with Deutsche Bank in New York, and a year later relocated to Hong Kong where he ran the equity principal strategies business. By mid-2009 he’d moved to London as a trader on the bond desk and eventually decided to branch off on his own. In 2010, he founded Knights Assets, an asset management company which handled firms like Rolls Royce and Eros International. It was during this time that his investment chops were recognized by the SoftBank Group and he was invited to join their Vision Fund in 2017. Knights eventually wound up and this Global Indian said, “The motivation to move away from my own venture to SoftBank was driven by my belief about the powerful network effects—ecosystem, ideas, and knowledge—that the scale of the Vision Fund’s resources would have perpetuated. With the benefit of hindsight, these network effect attributes have made me a better investor and entrepreneur. My journey has moulded me into a highly adaptable global citizen. It taught me to be open-minded and flexible when confronted with the ever-changing dynamics of the business world.”

An unlikely opportunity

As the pandemic hit the global economy last year, SoftBank felt the need to set the ball rolling for its $43 billion asset sale as it tried to recover from the massive losses it had incurred after debacles at WeWork and other Vision Fund portfolio companies. That was when Son decided to bring in Naheta to assist him in the process. Naheta eventually relocated to Abu Dhabi and has been involved in the planned sale of shares of Chinese internet giant Alibaba as SoftBank offloaded $13.7 billion of its holding.

The opportunity has also afforded Akshay Naheta some valuable lessons. “Masa is one of the world’s greatest investors and for all of us working at SoftBank, there is a lot to learn from him. His ability to always focus on the long term and to generate insights on the next big drivers of technological change are unique traits which will ensure that SoftBank continues to be the global leader in investing in disruptive businesses,” he said.

Turning India-wards

Given that SoftBank has considerable investments in India’s digital economy, Naheta hopes to have SB Management engage with the emerging Indian companies and participate in their IPOs or other offerings in the future. The potential Indian companies hold is tremendous. “I am also a keen observer of how India reforms listing norms to facilitate direct overseas stock market listings so as to attract larger global investors into its high growth companies,” he said.